First National Bank at Paris is unifying with our sister bank, Union Bank.

HERE'S EVERYTHING YOU NEED TO KNOW.

Announced in September 2023, everything is on schedule to complete the unification Presidents Weekend mid-February 2024. As you will note, the changes are minimal; however, this change will require getting a few systems unified as well. We have been a part of the same ownership, Union Bankshares, Inc., since 2005. You can be assured that we remain firm in our commitment to local bankers making local decisions. In addition, you will now have a choice of three additional locations.

Below are some important dates to look for.

FEBRUARY 1

Watch for your new debit card to arrive in the mail. For security purposes, it will arrive in a plain envelope. Follow the instructions on the mailer to activate your new card for use on February 20. Do not activate prior to February 20. Keep card in a safe place until then.

FEBRUARY 5

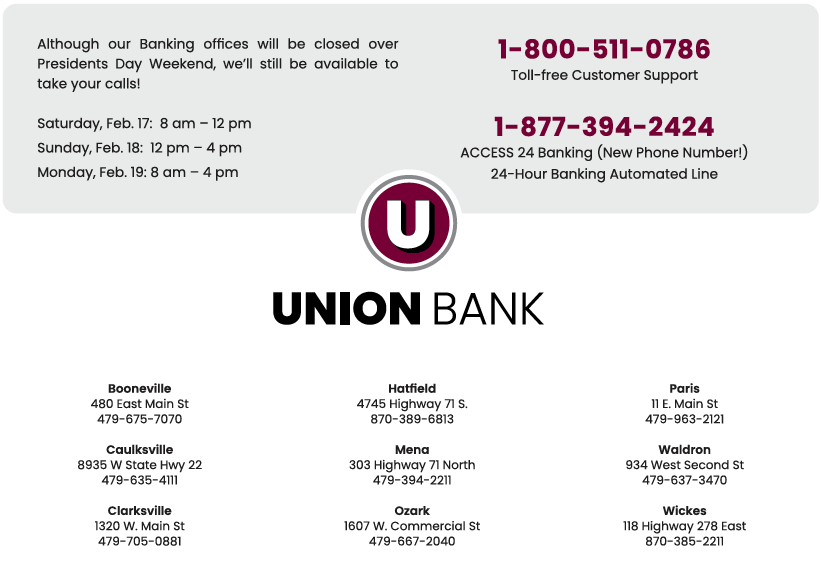

Watch for your new PIN (personal identification number) for your new debit card. For security purposes, it will arrive in a plain envelope. Keep your new PIN in a safe place until February 20 when you can begin using your new card and PIN. You can change your PIN at any Union Bank location after February 20 or by calling the ACCESS 24 phone number: 1-877-394-2424.

FEBRUARY 16

This is the last day to make changes to payees in your existing online banking account. All payments scheduled to occur on or before February 16 will be processed as scheduled. Statements for your FNBP | CNB accounts will be generated at close of business on February 16 at no charge.

FEBRUARY 17-18

Online and mobile banking, and our ACCESS 24 telephone banking service will be unavailable during our systems consolidation weekend from 7:00 pm on Friday, February 16 until 12:00 noon on Sunday, February 18.

Access online banking through the login page at GoUnion.Bank at noon on Sunday, February 18. Existing login and passwords will stay the same! If you need to reset your password, please call your branch. They will be taking calls during the conversion weekend. Please see below for extended call center hours. Online banking bill payments, recurring payments, transfers and alerts will carry over, and you can view your online banking history and statements.

You'll need your online and mobile banking login ID and password the first time you access the services, even if you typically login with facial recognition. For security, we will ask for authentication with a code sent to the phone number or email we have on file.

Download our new mobile banking app, GoUnionBank, from your app store. It will be available for immediate use beginning at noon on Sunday, February 18. Your existing login and passwords will stay the same! If you need to reset your password, please call your branch. We will be available during the weekend to assist you.

FEBRUARY 20

Activate your new debit card and begin using it. DO NOT ACTIVATE PRIOR TO FEBRUARY 20. If you have recurring payments tied to your card, contact each company (streaming services, mobile phone providers, insurance companies, gyms) to update payment information with your new debit card number, expiration date and security code.

MyFi 360 users will now access this service in the GoUnionBank app. Please re-enter your goals and budgets for tracking your progress, and re-enter accounts held at other financial institutions.

Re-enroll in Zelle, our convenient way to send receive money with people you trust.

Automatic Draft Payments | Social Security Deposits | Direct Deposits

The new routing number will be 082900982. Your account number is not changing. For recurring electronic transactions (automatic drafts, payments, deposits) tied to your accounts, we have been able to facilitate those changes through the appropriate agencies to ensure you will not have to do anything to change the routing number to ensure that your direct deposits or automatic payments/drafts continue to be processed. As always, we encourage you to monitor your account and contact us with any questions or concerns you may have.

It is important if you choose to contact these sources to update your routing number on your own to communicate that the effective date of the change is FEBRUARY 20. Anything posting with your account number and the new routing number will not be able to process BEFORE FEBRUARY 20. Rest assured, we're here to help you every step of the way and will work to ensure all payments clear your account as usual during this transition.

THINGS THAT AREN'T CHANGING:

- Continue to use your existing checks. Because we are sister banks, we will be able to continue to process your FNBP checks. When you run low on checks, please visit or call your local branch to ensure your reorder is printed with our new information.

- Loan payments made by automatic funds transfer require no action from you.

- First National Bank at Paris Credit Card customers will continue to use your existing credit card. We will contact you in May 2024 with more information.

- Online banking bill payments will continue with no action required from you.

- ACCESS 24 Banking will recognize your phone number and provide you with instant access to your account information and the features you currently enjoy. Make note of the new telephone number for ACCESS 24, 1-877-394-2424.